Quarterly Stamp Duty Land Tax (SDLT) statistics commentary

Updated 30 April 2024

Applies to England and Northern Ireland

1. About this release

This publication provides quarterly statistics on receipts and transactions for Stamp Duty Land Tax (SDLT) where the transaction value is £40,000 or above. It includes the whole of the UK up to April 2015; England, Wales, and Northern Ireland from April 2015 up to April 2018; and England and Northern Ireland from April 2018 onwards.

Data is split by property type, liability threshold and price band, including transactions paying the higher rates of SDLT for additional dwellings (HRAD), Non-Resident Stamp Duty Land Tax (NRSDLT) transactions and transactions claiming First Time Buyers’ Relief (FTBR).

HM Revenue and Customs (HMRC) has made improvements to the methodology for estimating HRAD and NRSDLT receipts and number of liable HRAD and NRSDLT transactions, effective from Q2 2022. These resulted in uplifts to both receipts and transaction numbers, and as such HRAD and NRSDLT data is no longer directly comparable to previous years.

This publication includes new SDLT return data for Q1 2024 (covering the period from 1 January to 31 March 2024), but it contains no new information on total SDLT receipts as these are published each month in the ‘HMRC tax receipts and National Insurance contributions for the UK’ publication. It should be noted that Q represents quarter within these statistics.

These statistics are National Statistics. National Statistics are accredited official statistics.

2. Headline findings

The headline findings in this quarterly report are:

2.1 Transactions

The headline transaction findings are:

-

total SDLT transactions in Q1 2024 (January to March) were 18% lower than in the previous quarter, and 8% lower than in Q1 2023

-

residential property transactions in Q1 2024 were 19% lower than in the previous quarter, and 8% lower than in Q1 2023

-

non-residential property transactions in Q1 2024 were 12% lower than in the previous quarter, and decreased by 1% compared to Q1 2023

2.2 Receipts

The headline receipts findings are:

-

total SDLT receipts in Q1 2024 were 23% lower than in the previous quarter, and 9% lower than Q1 2023

-

residential property receipts in Q1 2024 were 27% lower than in the previous quarter, and 13% lower than Q1 2023

-

non-residential property receipts in Q1 2024 were 14% lower than in the previous quarter, and 4% higher than Q1 2023

2.3 First Time Buyers’ Relief

The findings for FTBR are outlined below:

-

FTBR claims decreased by 19% between Q4 2023 and Q1 2024 from 31,100 to 25,300. A comparison to Q1 2023 shows a decrease of 2%

-

£120 million was relieved in Q1 2024 which represents a decrease of 18% compared to Q4 2023 and a decrease of 5% compared to Q1 2023

2.4 HRAD and non-UK resident surcharge

The headline HRAD and non-UK resident surcharge findings are:

-

43,800 transactions were liable to HRAD in Q1 2024, with the 3% element generating £343 million in receipts (net of refunds). This is a decrease of 26% from the previous quarter, and a decrease of 12% compared to Q1 2023

-

the percentage of residential receipts from HRAD transactions decreased by 1 percentage point from 49% in Q4 2023 to 48% in Q1 2024

-

the 2% surcharge on the purchase of residential properties by non-residents was charged in 4,300 transactions in Q1 2024. This is a decrease of 19% when compared to Q4 2023 which saw 5,300 transactions

-

in Q1 2024 the 2% surcharge on NRSDLT generated £38 million (net of refunds), compared to £63 million generated in Q4 2023

3. Stamp Duty Land Tax (SDLT)

SDLT is paid on property or land purchases in England and Northern Ireland. The SDLT due depends on the purchase price, with rates and thresholds differing depending on the property type or if it is an additional dwelling. Some transactions qualify for reliefs such as FTBR.

4. Key Summary

Figure 1: Total SDLT transactions and receipts have fallen in Q1 2024

Figure 1 demonstrates the following quarterly trends:

-

following the extension of the residential SDLT holiday to end in June 2021, total SDLT transactions peaked in Q2 2021 as taxpayers sought to complete transactions before the residential nil-rate band threshold reduced to £250,000 on 30 June 2021

-

total net SDLT receipts reached their highest levels in Q3 2022 due to an increase in transactions and the end of the residential SDLT holiday in September 2021, increasing the amount of tax paid on most residential transactions

-

the total number of SDLT transactions have fallen in the latest quarter to their lowest level since Q2 2020, when transactions dropped due to COVID-19

-

total net SDLT receipts have also fallen compared to the previous quarter to their lowest level since Q3 2020. However, the lowest receipt levels were in Q2 2020, coinciding with the lowest transaction levels

5. Quarterly Transactions

Figure 2: Transactions have fallen in the latest quarter, following increases in the previous two quarters

Figure 2 demonstrates the following quarterly trends:

-

residential and HRAD transactions peaked in Q2 2021 as taxpayers sought to complete transactions before the end of the residential SDLT holiday in June 2021

-

residential transactions (excluding HRAD), all liable HRAD transactions and non-residential transactions have fallen in the latest quarter

-

non-residential transactions this quarter are at their lowest level since Q3 2020

-

residential and HRAD transactions are at their lowest level since Q2 2020, when transactions dropped due to COVID-19

6. Summary of key definitions

6.1 Standard rate transactions

Refers to liable residential transactions that are not purchased as additional dwellings or purchased by non-individuals.

6.2 Liable and non-liable

The split between the liable and non-liable transactions is dependent on the level of the SDLT threshold. The current SDLT threshold is £250,000 for residential properties and £150,000 for non-residential properties.

6.3 Price bands

Transactions under £250,000 do not include transactions valued at less than £40,000 as these transactions do not require returns and are therefore not captured in HMRC’s Stamp Duty Land Tax database. Further information can be found in the Methodology Quality Report Annual UK Stamp Tax statistics - January 2024 report published on the GOV.UK website. This document was published on 31 January 2024.

7. Residential transactions

7.1 Definition

Residential property refers to buildings used or suitable for use as a dwelling, or in the process of being constructed for use as a dwelling. It also includes the gardens and ground of dwellings.

The summary findings for residential transactions in this quarterly report are:

-

89% of all SDLT transactions were for residential properties in Q1 2024

-

this remained unchanged from Q4 2023, and remained unchanged from Q1 2023

-

the number of residential property transactions in Q1 2024 was 19% lower than in the previous quarter, and 8% lower than in Q1 2023

-

liable residential transactions decreased by 20% between Q4 2023 and Q1 2024 (from 127,400 to 101,600), and comparison to Q1 2023 shows a 10% fall

-

non-liable residential transactions decreased in Q1 2024, by 18% compared to Q4 2023 (from 110,300 to 90,900), whilst comparison to Q1 2023 shows a 7% decrease (from 97,300)

7.2 Non-residential transactions

Non-residential transactions (liable and non-liable) decreased by 12% from 28,300 in Q4 2023 to 24,900 in Q1 2024. Non-residential transactions decreased by 1% from 25,200 in Q1 2023.

7.3 Residential - Liable transactions

The summary findings for residential liable transactions in this quarterly report are:

-

in Q1 2024, 53% of residential transactions were liable for SDLT, compared to 54% in Q1 2023

-

liable residential transactions decreased by 20% between Q4 2023 and Q1 2024 (from 127,400 to 101,600). Comparison to Q1 2023 shows a 10% fall

-

25% of liable residential transactions were valued at under £250,000. Liable transactions in this band decreased by 10% from 28,700 to 25,900 when comparing Q1 2023 to Q1 2024

-

comparing between Q1 2023 and Q1 2024, liable residential transactions valued between £250,000 to £500,000 have decreased by 10% from 53,000 to 47,900 while combined liable residential transactions over £500,000 decreased by 11% from 31,100 to 27,800

8. Higher rates of SDLT transactions for Additional Properties

Additional dwellings purchased by individuals and residential property purchased by non-individuals are required to pay the standard rate of SDLT plus 3%. This applies for example to purchases of second homes and buy-to-let properties. These rates, formally known as higher rates for additional dwellings (HRAD or ‘higher rates’), were introduced in April 2016. Repayments of the higher rates are available to an individual who has sold their previous main residence within 36 months of paying the higher SDLT rates.

HMRC has made improvements to the methodology for estimating HRAD receipts paying 3% surcharges and number of liable HRAD transactions, effective from Q2 2022. These have resulted in uplifts to both receipts and transaction numbers from Q2 2022 onwards, and as such data is no longer directly comparable to previous years.

The summary findings for higher rates of SDLT transactions in this quarterly report are:

-

liable HRAD transactions decreased by 9% from 48,100 in Q1 2023 to 43,800 in Q1 2024. When comparing to Q4 2023 there has been a fall of 14%

-

HRAD transactions account for 43% of all liable transactions, this remained unchanged compared to Q1 2023. Comparing to Q4 2023 shows an increase of 3 percentage points

-

around 57% of HRAD transactions were under £250,000 in Q1 2024. HRAD transactions in this band decreased by 9% from 27,300 in Q1 2023 to 24,800 in Q1 2024

9. Non-Resident Stamp Duty Land Tax (NRSDLT)

HM Revenue and Customs has also made improvements to the methodology for estimating NRSDLT receipts and number of liable NRSDLT transactions, effective from Q2 2022. These have resulted in uplifts to both receipts and transaction numbers from Q2 2022 onwards, and as such data is no longer directly comparable to previous years.

A 2% surcharge for NRSDLT was introduced on the purchase of properties by non-residents from 1 April 2021 (the start of Q2 2021). The statistics for this change to the SDLT system show:

-

up to Q1 2024 there have been 58,900 transactions that have incurred the surcharge yielding £591 million of additional tax (net of refunds)

-

NRSDLT transactions decreased by 7% from 4,600 in Q1 2023 to 4,300 in Q1 2024, and there was a decrease of 19% from 5,300 transactions in Q4 2023

10. First Time Buyers’ Relief

FTBR was introduced in November 2017 and applied to purchases of dwellings for £500,000 or less, provided the purchaser has never owned a property and intends to occupy the property as their only or main residence. Under the relief, transactions valued at £300,000 or less were not liable. The thresholds were increased on 23 September 2022 so that it applies to transactions of £625,000 or less with no tax payable for properties valued at £425,000 or less.

The residential SDLT holiday between 8 July 2020 and 30 June 2021 meant that there was no requirement to claim FTBR. As such, we only report figures up to Q3 2020 and from Q3 2021 for this relief.

The findings for FTBR are outlined below:

-

FTBR claims decreased by 19% between Q4 2023 and Q1 2024 from 31,100 to 25,300. A comparison to Q1 2023 shows a decrease of 2%

-

£120 million was relieved in Q1 2024 which represents a decrease of 18% compared to Q4 2023 and a decrease of 5% compared to Q1 2023

-

in the latest quarter 13% of residential transactions claimed the relief, remaining unchanged compared to the previous quarter

11. Non-residential transactions

11.1 Definition

Includes, commercial property, agricultural land, forests, any other land, or property which is not residential, 6 or more residential properties bought in a single transaction, and mixed-use transactions.

The summary findings for non-residential transactions in this quarterly report are:

-

non-residential transactions (liable and non-liable) decreased by 1% compared to Q1 2023 (from 25,200 to 24,900), while there was a decrease of 12% from 28,300 in Q4 2023

-

68% of non-residential transactions were liable for SDLT in Q1 2024, this is the same compared to Q4 2023

-

liable non-residential transactions remained unchanged from 16,900 in Q1 2023

-

there were 10,800 liable non-residential transactions under £250,000 in Q1 2024, increasing by 2% compared to Q1 2023

-

over the same quarterly comparison period, transactions between £250,000 to £500,000 decreased by 4% to 2,600 from 2,700, whilst transactions valued at £500,000 and over remained unchanged

12. Quarterly Receipts

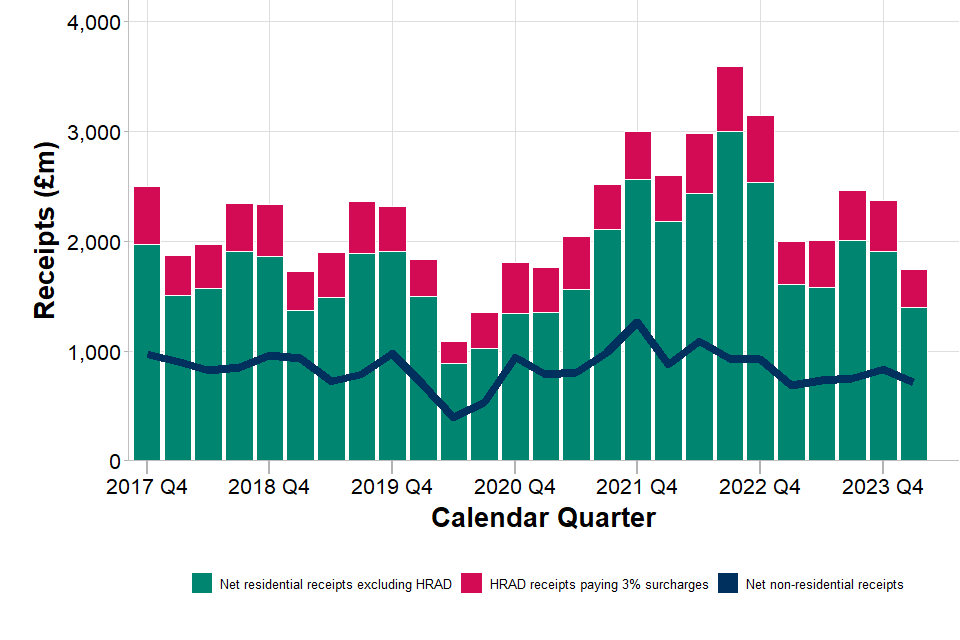

Figure 3: Residential receipts (excluding HRAD residential receipts) have fallen, mirroring a fall in residential transactions. Non-residential receipts have also decreased, driven by a decline in non-residential transactions

Figure 3 demonstrates the following quarterly trends:

-

net residential receipts and HRAD 3% receipts peaked in Q3 2022, coinciding with an increase in transactions and the end of the residential SDLT holiday in September 2021

-

net non-residential receipts peaked in Q4 2021, coinciding with a peak in non-residential transactions in this quarter

-

in the latest quarter, residential receipts have fallen to their lowest level since Q3 2020, driven by a fall in residential non-HRAD receipts

-

non-residential receipts have also declined in the latest quarter, coinciding with a decrease in non-residential transactions

12.1 Summary

The summary findings for receipts in this quarterly report are:

-

quarterly net SDLT receipts decreased by 9% between Q1 2023 and Q1 2024: £2,685 million in Q1 2023 compared to £2,455 million in Q1 2024. A comparison to Q4 2023 shows a decrease of 23%

-

residential SDLT receipts decreased by 13% between Q1 2023 and Q1 2024: £1,995 million in Q1 2023 compared to £1,740 million in Q1 2024. A comparison to Q4 2023 shows a decrease of 27%

-

total receipts for transactions liable to HRAD decreased by 13%, from £967 million in Q1 2023 to £838 million in Q1 2024 while comparison to Q4 2023 shows a decrease of 28%

-

48% (£838 million) of residential receipts were from HRAD transactions in Q1 2024, of which £343 million are estimated to be from the additional 3% rate

-

in Q1 2024 there was a total of 5,600 additional dwellings refunds made for which a total amount of £103 million was refunded

-

non-residential receipts increased by 4%, from £690 million in Q1 2023 to £715 million in Q1 2024, while comparison to Q4 2023 shows a decrease of 14%

13. Background information - recent changes in stamp taxes

On 8 July 2020, the SDLT holiday was introduced. This raised the nil rate band for SDLT to £500,000 for the purchase of residential properties. On 1 April 2021, a 2% Non-Resident Stamp Duty Land Tax surcharge was introduced for non-residents who purchase residential property.

The SDLT holiday continued until 30 June 2021, after which time the nil-rate band reduced to the first £250,000 of the purchase price until 30 September 2021. Beyond this date the nil-rate band reverted to the first £125,000 of the purchase price.

On 23 September 2022, the government announced that the 2% standard rate for residential properties for the part of the property price between £125,000 and £250,000 no longer applies. The announcement also included the raising of the thresholds for FTBR so that these purchases are completely exempt for the first £425,000 of the purchase price. The total purchase price, lease premium or transfer value under which first time buyers could qualify for the relief was also increased from £500,000 to £625,000.

14. Methodology and Quality report

For key definitions, guidance and references see the published tables and the Quality report for UK Stamp Taxes Publication.

15. Contact information

Email stamptaxes.statistics@hmrc.gov.uk

Go to the following link for further Stamp duties statistics.

Media 03000 585 024